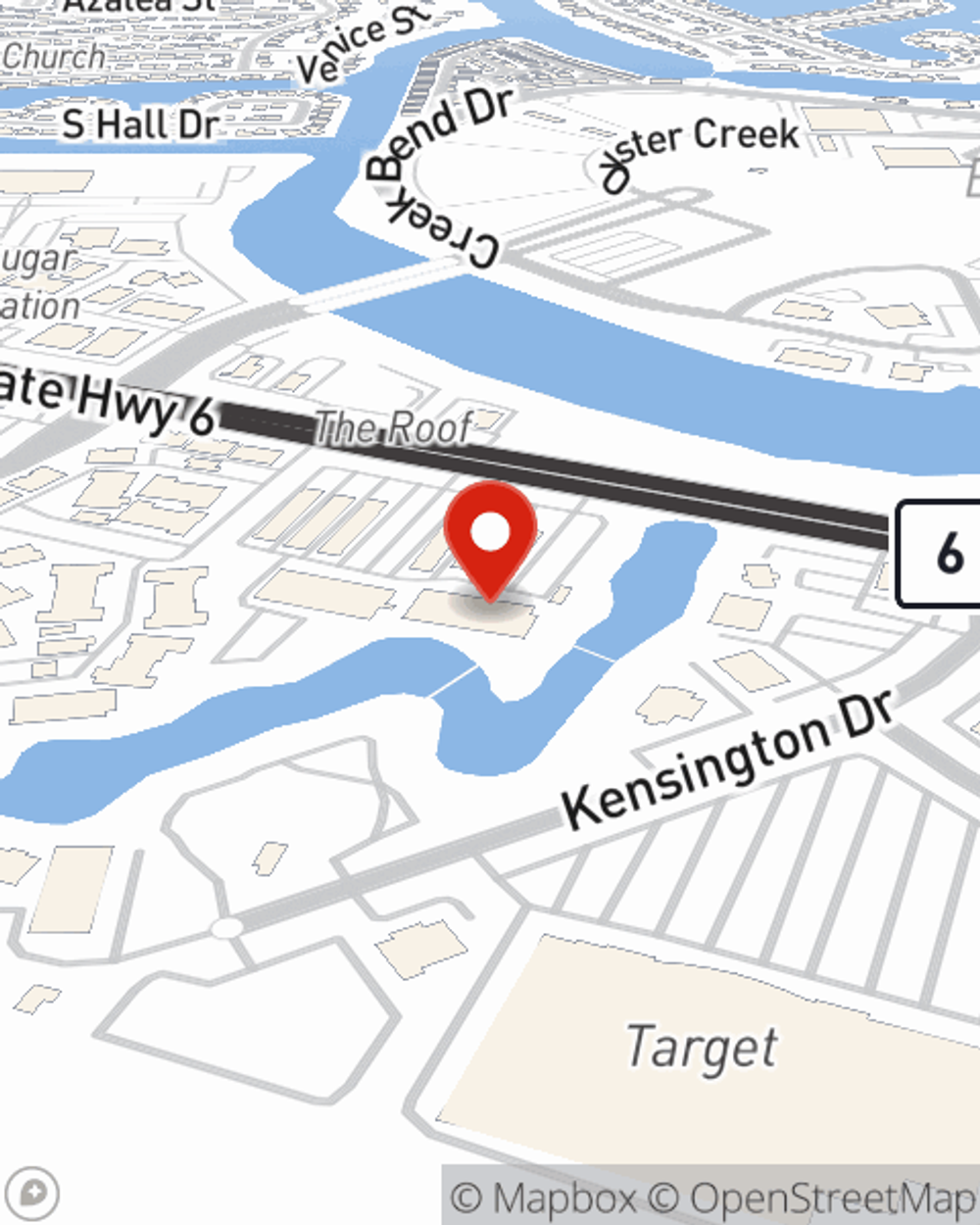

Renters Insurance in and around Sugar Land

Sugar Land renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Sugar Land

- Fort Bend County

- Richmond

- Rosenberg

- Katy

- Houston

- Brazoria

- Austin

- Fredericksburg

- Comfort

Home Sweet Home Starts With State Farm

Trying to sift through coverage options and savings options on top of work, family events and your pickleball league, isn’t easy. But your belongings in your rented home may need the incredible coverage that State Farm provides. So when trouble knocks on your door, your home gadgets, pictures and videogame systems have protection.

Sugar Land renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Why Renters In Sugar Land Choose State Farm

You may be questioning if having Renters insurance can be beneficial, but what many renters don't know is that your landlord's insurance generally only covers the structure of the condo. What would happen if you had to replace your belongings can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when windstorms or tornadoes occur.

If you're looking for a dependable provider that can help you understand your options, get in touch with State Farm agent John Bowers today.

Have More Questions About Renters Insurance?

Call John at (281) 242-4800 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

John Bowers

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.